Today Erin uncovers two industry groups that are showing strength and potential in the short term. She takes a look “Under the Hood” to reveal participation and trends that are quite bullish.

Carl walks us through the market overall, covering not only the SPY, but also interest rates, Bonds, Gold, Silver, Gold Miners, Crude Oil and the Dollar.

After a look at the overall market, Carl pays special attention to Apple’s (AAPL) buyback and what it means for the market. Additionally, he looked at the remaining Magnificent Seven daily charts and determines which are set up to perform well and which could be in trouble.

The pair finish the program with viewer’s symbol requests which included ARM, MU and SMCI.

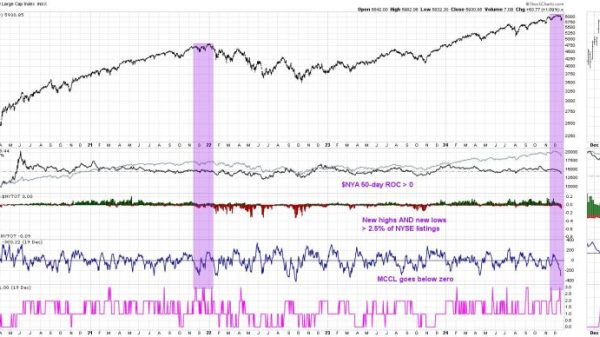

01:05 Market Signal Tables

03:34 Market Overview

10:21 Apple (AAPL) and the Magnificent Seven

14:56 Sector Overview

20:30 Industry Groups to Watch

27:46 Symbol Requests

Watch the latest episode of the DecisionPoint Trading Room on DP’s YouTube channel here!

Try us out for two weeks with a trial subscription!

Use coupon code: DPTRIAL2 at checkout!

Technical Analysis is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)