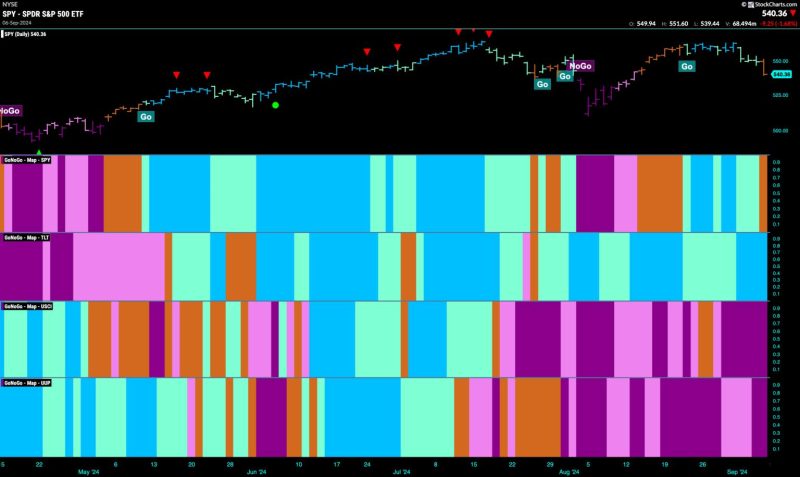

Good morning and welcome to this week’s Flight Path. Equities flashed an uncertain “Go Fish” bar at the end of the week as the markets became even more unsettled. Treasury bond prices remained in a “Go” trend and saw that trend was strong for almost all of last week. U.S. commodity index remained in a “NoGo” painting strong purple bars the entire week and it was no picnic for the dollar either. The greenback saw the “NoGo” continue and the week ended with a couple of purple bars.

$SPY Falls Out of “Go” Trend

The GoNoGo chart below shows that after seeing trend weakness with aqua bars the week ended with an amber “Go Fish” bar. This most recent “Go” move was unable to set a new higher high before the GoNoGo Trend indicator painted a “Go Fish” bar of uncertainty. We look at the oscillator panel and see that after briefly testing the zero level from above GoNoGo Oscillator fell into negative territory on heavy volume. This inability to find support at zero was a concern for the “Go” trend.

The longer time frame chart shows that last week was a bad one. However, we still see that the trend is a “Go” painting blue bars. We can see that price hasn’t made a new higher high but the trend remains and GoNoGo Oscillator is in positive territory at a value of 2. We will watch to see as the oscillator gets closer to zero if it finds support at that level.

Treasury Yields Stay in “NoGo” Trend

Treasury bond yields painted strong purple “NoGo” bars this week and we saw a sharp fall that saw a challenge of recent lows. In the oscillator panel, we see that a Max GoNoGo Squeeze was broken to the downside, with GoNoGo Oscillator falling into negative territory. This tells us that momentum is surging in the direction of the underlying “NoGo” trend and so we see a NoGo Trend Continuation Icon (red circle) in the above panel.

The Dollar’s “NoGo” Remains

As strong purple bars return we see that the U.S. dollar has made a new lower low. GoNoGo Trend shows that trend strength returned at the end of the week and so the weight of the evidence tells us that the “NoGo” trend is in full force. If we look at the oscillator panel, we see that GoNoGo Oscillator has rallied to test the zero line from below. It has remained stuck at that level for several bars and so we see a GoNoGo Squeeze building. As we see heavy volume, it will be important to watch for the direction of the break of the GoNoGo Squeeze.