Friday was a bad day for CrowdStrike Holdings (CRWD) as a bug was pushed out that disrupted Windows machines worldwide. The trouble for CRWD is the follow-up lawsuits etc that will likely plague the stock for some time to come. You’ll be shocked to see the warning signs all over the chart that portended some kind of correction for CRWD even before the pandemonium.

Another special discussion was Carl’s newfound Bond ETFs that follow Treasuries of all time periods. These ETFs pay dividends once a month and act as owning Treasures but with the flexibility of an ETF. Do a search on FMINVEST.com for more information. Below is the list of ETFs.

Carl goes over the DP Signal Tables which look especially bullish right now. Things are as good as they can get, now what? Carl proceeds with giving us a complete review of the market in general as well as his thoughts on Bitcoin, Bonds, Gold, Crude Oil and more.

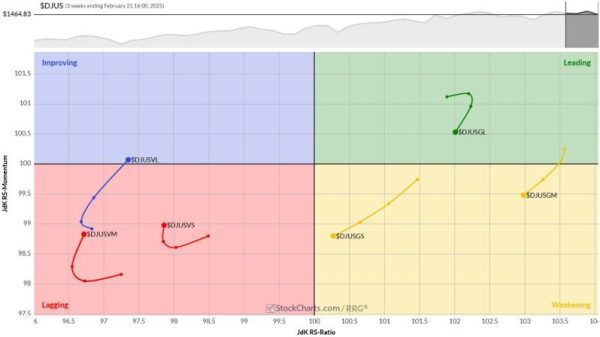

A review of the Magnificent Seven rounded out Carl’s portion of the trading room. Erin takes the reins and discusses today’s rotation back into growth and Technology. Can it last? Which sectors are lined up the best going into this week?

Erin finishes up the trading room with symbol requests that answer the question of whether to buy or sell or hold those stocks.

01:03 DecisionPoint Signal Tables

03:47 Market Overview

13:06 Magnificent Seven Analysis

16:05 CrowdStrike Chart

18:56 Treasury ETFs & Questions

27:18 Sector Rotation

34:33 Symbol Requests

Click HERE to reach the latest DP Trading Room videos!

Watch the latest episode of the DecisionPointTrading Room on DP’s YouTube channel here!

Try us out for two weeks with a trial subscription!

Use coupon code: DPTRIAL2 at checkout!

Technical Analysis is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)