Many chatter and mentions of weak or narrow breadth are floating around these days. I plead guilty as well.

I want to approach this from another angle using some of the major US stock indices for this article.

I usually examine the market using sectors or a growth/value/size breakdown, with the S&P and Dow Jones indices playing a major role. But there is more.

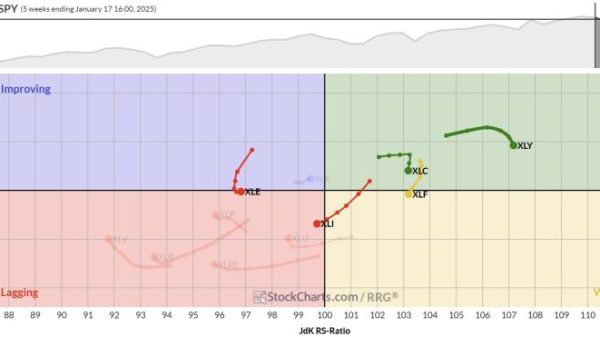

Major US Stockmarket Indices

The first RRG shows the rotation of some of the major US stock market indices against the benchmark S&P 500.

I have added the table below the graph as a legend for the symbols on the tails, as they may not be so mainstream.

The tails and the accompanying performances are shown over a five-week period. All the broader indices are camping inside the lagging quadrant and traveling at a negative RRG-Heading, while the narrower-based indices are inside the leading quadrant and on a strong, 0-90 degrees RRG-heading.

There is no index inside the improving quadrant or the weakening quadrant. This indicates the clear split between these two groups.

The only exception concerning “broader” indices is the Nasdaq Composite index ($COMPQ) with 2500 stocks. However, this index is, very, heavily tilted toward the software & It services and technology equipment stocks. The exception on the “narrower” indices is the DJ Industrials index, which has a relatively low exposure to the technology sector, also because of its price-weighted approach.

When I remove $COMPQ and $INDU and set the tail length to 3 weeks for better visibility, this is the chart that remains. I found it interesting that the further you go to the right, the smaller the index becomes in terms of stocks in the index, not necessarily in market capitalization.

NY FANG Beats All

The next step was to zoom in on the rotation of $NYFANG.

When I set the tail length to 30 weeks, the exact same indices show up on top, with $NYFANG handsomely beating all other indices in this group. When you open up this RRG, live (click on the chart), you have to scroll back to 3/13/2023 before $NYFANG drops from the first place over a 30-week period. That’s a pretty impressive period (trend).

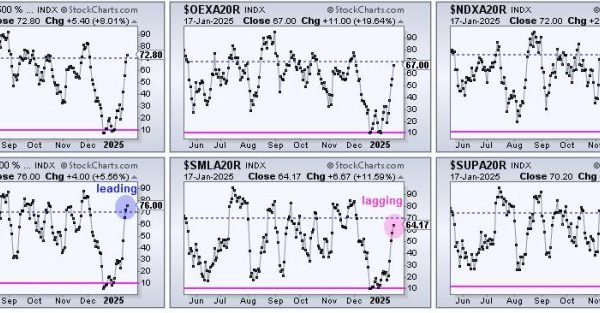

Even Inside The NY FANG Index, The Base is Narrow

And finally, let’s zoom in on the members of the NY FANG index.

This RRG shows the rotation for the NYFANG members against $NYFANG. The first observation is a high concentration of stocks inside the lagging quadrant. Except for SNOW and AMD, they have beaten the S&P 500 over this 5-week period. But not $NYFANG. Only TWO stocks have outperformed $NYFANG over this 5-week period: TSLA and NVDA.

Looking back, 30 weeks shows that only NVDA, META, and NFLX have beaten $NYFANG.

The big spread between the top and bottom of the list, +38.4% for TSLA and -1.8 % for AMD, also shows that the performances are very stock-specific. Even within the same sector, big differences show up. MSFT (Technology/ software) shows an 11% gain vs. SNOW in the same group, with a 4.9% gain.

The difference is even bigger in semiconductors. NVDA (Technology/semiconductors) +17% against a loss of 1.8% for AMD in the same group.

The main takeaway from all this, IMHO, is that the foundation is indeed narrow and concentrated in large cap, offensive/growth stocks. This group of stocks can still keep the S&P 500 going up or at least remain sideways during transition periods. This is caused by individual stocks rotating through very strong, relative trends.

As long as this situation persists, I believe it will be much more important to focus on individual stocks first, then sectors, and only then the broader market.

Happy Fourth Of July, –Julius