As consumers become more selective in their spending, restaurants and travel remain bright spots in consumer spending. With American Express’s focus on premium customers who continue to spend in these categories, AXP is positioned to outperform its industry. As they focus on a younger customer base and grow their presence in international markets, AXP has acquired new customers at an accelerated pace.

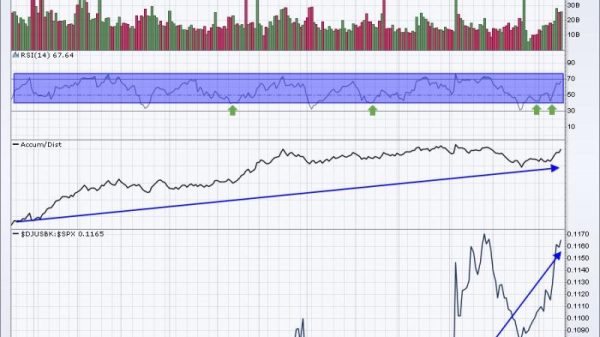

If you look at a chart of AXP below, you can see it’s had an incredible run over the past year, rallying nearly 60% from the Oct 2023 lows, and recently, pulling back 8% from its peak a few weeks ago. As momentum, measured by the Relative Strength Index (RSI), starts to reach oversold conditions, this presents a more attractive risk/reward for adding long exposure within this strong bullish trend.

CHART 1. DAILY CHART OF AMERICAN EXPRESS. The RSI is oversold, presenting a more attractive risk/reward scenario for adding long exposure.Chart source: StockCharts.com. For educational purposes.

Shifting over to the business, AXP is expected to grow earnings-per-share (EPS) at an above-average clip of 15% and revenue at 9%, yet it trades at a 12% discount to the average S&P 500 stock. With net interest income and card fees expected to grow, this discount reflects the upside opportunity for AXP to trade back towards its 52-week highs and beyond.

With IV Rank @ 16%, options are not cheap, but also not expensive. In this scenario, because there isn’t a catalyst over the next few weeks, I prefer buying an ITM debit spread, which would minimize the time decay that I would have to pay for upside exposure. This would involve the following:

Buying the August $220 Calls @ $10.80

Selling the August $240 Call @ $3.00

This strategy would risk $780 per contract if AXP is below $220 at expiration, while potentially profiting $1,220 per contract if AXP rallies above $240 at expiration (see below).